American Beef Export Trade Stats: September 2021

Beef Highlights:

September 2021:

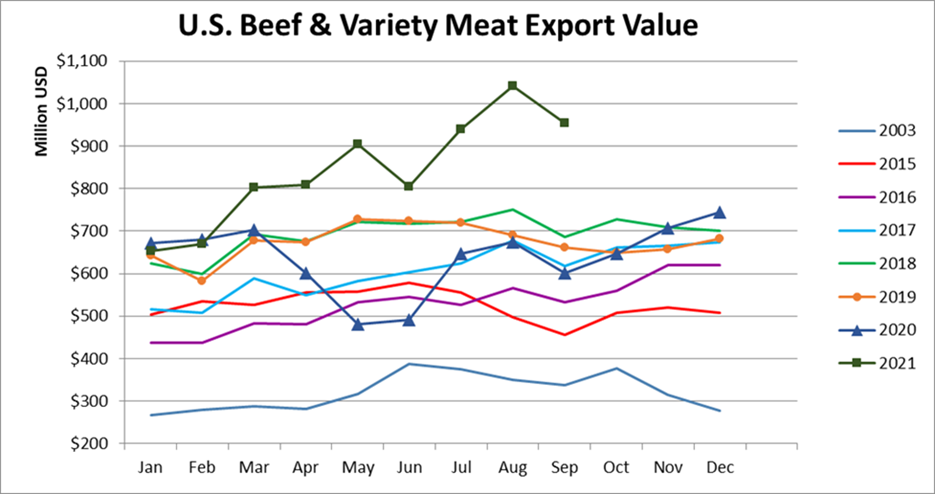

Beef: 95,726 mt, +20% and the fifth highest monthly volume, $857 million, +62% and the second highest value after August

BVM: 27,902 mt, +15%, $97 million, +38% and the second highest value after August

Beef + BVM: 123,628 mt, +20% and the fourth highest monthly volume since BSE, $954 million, +59% and the second highest value after August

January – September 2021:

Beef: 852,280 mt, +21%, $6.814 billion, +39%

BVM:226,755 mt, +10%, $762 million, +19%

Beef + BVM: 1.079 mt, +18%, $7.576 billion, +36

September beef muscle cut exports totaled 95,762 mt, up 16,745 mt from last year, up 12,001 mt from September 2019 and the fifth highest monthly volume on record (after August, May, March, and July of this year). September beef export value was up 62% from last year (or up $326 million) and up 48% from 2019 at $857 million, the second highest monthly export value after $942 million in August. Exports were higher than last September to China/HK (+10,100 mt), Japan (+2,150 mt), Korea (+2,100 mt), Mexico (+1,100 mt), Caribbean + DR (+970 mt), South America (+930 mt), Central America (+440 mt), the Middle East (+390 mt), EU27+UK (+230 mt), and Africa (+110 mt), while exports were lower to ASEAN (-640 mt), Canada (-610 mt), and Taiwan (-460 mt). Exports to both Korea (22,649 mt, +10%) and Japan (21,806 mt, +11%) moved seasonally lower from August to September but were above 2020 and 2019 levels. Combined exports to China/HK totaled 20,833 mt, up 94% from last year and the second highest monthly volume after August. Exports to China (17,468 mt, +312%) were the second highest after 19,924 mt in August, while exports remained at the lowest levels since 2012 to Hong Kong (3,365 mt, -48%). Exports to Canada (7,524 mt, -7%) were the lowest since March. Exports to Mexico (7,408 mt, +17%) were above last year’s low levels but were down 29% from 2019 and were the second lowest this year after June. Exports to Taiwan (5,293 mt, -8%) were down from last September but were up 4% from 2019. For the ASEAN region, exports to Indonesia (1,412 mt, +53%) slowed from the recent highs of over 2,000 mt per month in July and August but remained strong. Exports were also higher to Singapore (343 mt, +23%), but exports were below year-ago levels for the second consecutive month to the Philippines (631 mt, -22%) and for the fourth month to Vietnam (208 mt, -79%). Exports to Chile (905 mt, +115%) were the highest since November 2019, while exports to Colombia (467 mt, +203%) reached the third highest monthly volume, and exports to Peru (194 mt, +94%) rebounded to the highest level since March 2020. Exports to the DR (793 mt, +331% from 2020, +63% from 2019) were the third highest on record after August of this year (803 mt) and April 2015 (835 mt). Exports to the Bahamas (221 mt, +50% from last year) were above year-ago and 2019 levels for the second consecutive month in September. Exports to Guatemala (647 mt, +71%) and Costa Rica (269 mt, +60%) remained on a record pace. Exports to Kuwait (318 mt, +1,123% from 2020, +53% from 2019) were the highest since April, while exports to UAE (306 mt, +16%) were down 33% from September 2019. Exports to South Africa (123 mt, up from 0 mt of muscle cuts last year) were the highest since 2018.

September beef variety meat exports totaled 27,902 mt, up 3,606 mt from last year and up 1,828 mt from 2019. Beef variety meat exports were the second highest of the year after the May total of 28,347 mt and were otherwise the highest since 2019. Beef variety meat exports were higher than last year to Japan (+3,700 mt), Mexico (+1,100 mt), the Middle East (+510 mt), China/HK (+380 mt), Central America (+320 mt), and the ASEAN (+40 mt). Exports were lower to Africa (-1,800 mt), South America (-320 mt), Korea (-140 mt), Caribbean + DR (-110 mt), and Canada (-80 mt). Beef variety meat exports to Mexico (8,214 mt, +15%) were the highest since May but were down 9% from September 2019. Following a strong month in August, September beef variety meat exports to Japan (8,165 mt, +81%) set a new post-BSE high. Exports to Egypt (4,520 mt, +11%) were the highest since May but were down 16% from 2019. Combined exports to China/HK totaled 1,508 mt, up 34% from last year and up 75% from 2019. Exports to China (888 mt, +82%) were up from 739 mt in August, but the record high was 1,226 mt in May. Exports to Hong Kong (620 mt, -3%) were down slightly from last year and down 27% from 2019. Exports to Peru (841 mt, -22%) were down from last year but remained strong and were up 58% from 2019. Exports to Colombia (252 mt, +11%) were the highest since April. Exports to South Africa (796 mt, -61%) trended up from 533 mt in August but were otherwise the lowest since December (and down 16% from 2019), and exports to Gabon (215 mt, +5%) were the highest since April. Exports to Indonesia (772 mt, +27%) slowed from the recent highs during the previous three months and were down 28% from 2019. Exports to Korea (714 mt, -17%) were the highest since last October but were down 24% from 2019. Exports to Canada (418 mt, -16%) were the lowest since September 2017. Exports were lower than last year to Jamaica (289 mt, -27%) but were up 5% from 2019.

January – September beef and variety meat exports totaled 1.079 million mt, up 18% or +167,000 mt from last year (with value up 34% or +$2.2 billion from last year to $7.58 billion). Year-to-date exports were higher year-over-year in volume to China/HK (+100,200 mt), Korea (+23,600 mt), Mexico (+21,650 mt), Japan (+12,650 mt), ASEAN (+8,000 mt), Central America (+5,600 mt), South America (+4,250 mt), Caribbean + DR (+3,200 mt), and the Middle East (+2,600 mt). Exports were lower year-over-year to Africa (-6,200 mt), Canada (-6,150 mt), Taiwan (-1,300 mt), EU27 + UK (-890 mt), and the surrounding Russia region (-40 mt).

September beef exports accounted for 13.0% of production and 15.7% when adding variety meats, as compared to 10.5% and 12.8% in September 2020. January – September 2021 beef exports accounted for 12.8% of production and 15.1% when adding variety meats, compared to 11.0% and 13.2% for January – September 2020.

September beef export value per head of fed slaughter averaged $447.46/head, up 63% or +$173.16/head from $274.30/head in September 2020. January – September 2021 beef export value per head of fed slaughter averaged $389.08/head, up 32% or +$93.88/head from $295.21/head for January – September 2020.

Source: USMEF