American Beef Export Trade Stats: October 2022

Beef Highlights:

October 2022:

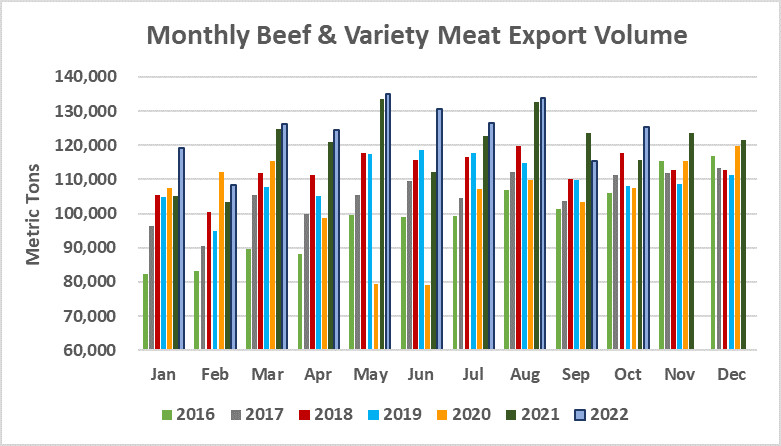

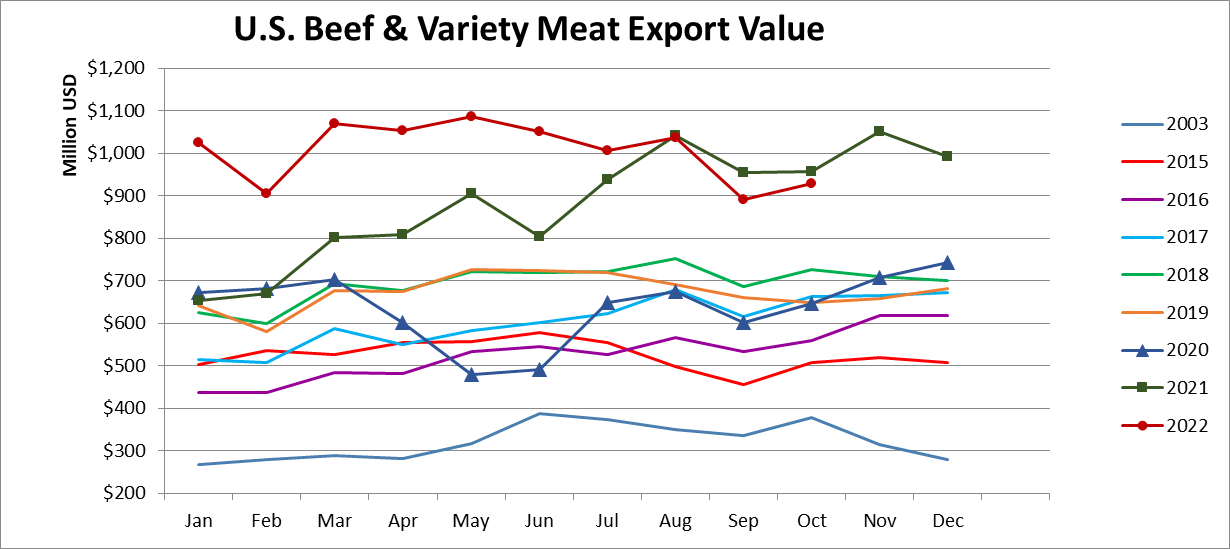

Beef: 100,348 mt, +7.5%; $825 million, -4%

BVM: 25,118 mt, +12%; $105 million, +8%

Beef + BVM: 125,466 mt, +8%; $930 million, -3%

January – October 2022:

Beef: 994,735 mt, +5%, $9.002 billion, +17%

BVM: 250,521 mt, +0.6%; $1.051 billion, +22%

Beef + BVM: 1.245 million mt, +4%; $10.053 billion, +18%

October beef muscle cut exports totaled 100,348 mt, up 7.5% or +7,011 mt from last year. Compared to last year, beef muscle cut exports were higher to China/HK (+3,560 mt), ASEAN (+2,890 mt), Korea (+1,700 mt), Canada (+1,170 mt), Mexico (+320 mt), and the Middle East (+300 mt). Exports were lower to South America (-1,100 mt), Caribbean + DR (-470 mt), Taiwan (-550 mt), Central America (-350 mt), Japan (-320 mt), and EU27 + UK (-160 mt). Exports to the ASEAN region (5,720 mt, +102%) were higher than last year driven by the Philippines. October exports to the Philippines (2,620 mt, +340%) were the highest ever recorded. Through October, beef muscle cut export volume to the Philippines is 19% higher than the total of 2019, which held the title for highest volume ever recorded until now. Exports to Vietnam (1,130 mt, +269%) were higher year-over-year and were the highest since November 2020, and exports were also higher to Indonesia (1,410 mt, +2%). Exports slowed slightly compared to last year to Japan (19,110 mt, -2%) in October. Exports to Mexico (8,580 mt, +4%) were higher year-over-year reaching the highest level so far this year. Exports to Central America (1,490 mt, -19%) were the highest since March of this year, but were lower year-over-year. Exports to Canada (8,380 mt, +16%) and Korea (23,210 mt, +8%) were higher year-over-year. Exports to the Caribbean + DR (1,500 mt, -24%) slowed to the second lowest level this year. Exports were higher than a year-ago to the Middle East (1,520 mt, +25%), driven by exports to Kuwait (480 mt, +130%), which were the highest since November 2021, as well as exports to Qatar (260 mt, +51%). Exports to China/HK (23,890 mt, +18%) were the second highest ever recorded behind August 2022, driven by exports to China (21,120 mt, +31%), while exports to Hong Kong (2,770 mt, -35%) slowed, but reached the second highest volume this year. Exports to Taiwan (4,370 mt, -11%), EU27 + UK, and South America (940 mt, -54%) were lower year-over-year.

October beef variety meat exports totaled 25,118 mt, up 12% or +2,750 mt from last year. Exports were higher than last year to China/HK (+900 mt), ASEAN (+610 mt), Middle East (+580 mt), Korea (+550 mt), Japan (+480 mt), Canada (+410 mt), Caribbean + DR (+180 mt), and Mexico (+165 mt). Exports were lower to Africa (-500 mt), South America (-460 mt), and Central America (-200 mt). Exports to China/HK (2,290 mt, +64%) were higher year-over-year, but were the second lowest level this year. Exports to China (1,650 mt, +120%) were higher year-over-year, but reached the second lowest level this year, while exports to Hong Kong (640 mt, -0.5%) slowed slightly. Exports were higher than a year-ago to Mexico (7,750 mt, +2%), but exports slowed to Central America (240 mt, -46%). Exports to Costa Rica (90 mt, +55%) were the highest level since September 2021, while exports slowed to Nicaragua (50 mt, -25%). Exports to Korea (980 mt, +129%) reached the highest level this year. Exports were lower year-over-year to South America (1,120 mt, -29%) with volume down to Chile (200 mt, -9%), Colombia (320 mt, -42%), and Peru (590 mt, -13%). Exports to Egypt (4,540 mt, +15%) were the highest since January of this year. Exports to the Caribbean + DR were higher year-over-year driven by Jamaica (360 mt, +104%) reaching the second highest level this year, while exports to the Dominican Republic (90 mt, -12%) slowed. Exports to Africa (570 mt, -47%) slowed, but exports to Angola were up to 190 mt from 0 mt in October 2021 and exports to Cote d’Ivoire (80 mt, +46%) were also higher year-over-year. Exports to South Africa (260 mt, -59%) slowed to the lowest level since January. Exports to the Philippines hit 630 mt, up from 30 mt last year and exports to Indonesia (840 mt, -5%) slowed, but were the second highest level this year. Exports to Japan (4,490 mt, +12%) and Canada (950 mt, +76%) were higher year-over-year.

January – October beef muscle cut + beef variety meat exports totaled 1.245 million mt, up 4% or +50,512 mt from last year. Exports were higher to China/HK (+44,790 mt), Korea (+8,790 mt), ASEAN (+8,540 mt), EU27 + UK (+5,570 mt), Middle East (+5,120 mt), Taiwan (+4,200 mt), Caribbean + DR (+3,730 mt), and Canada (+2,880 mt). Exports were lower to Mexico (-14,710 mt), Japan (-9,500 mt), Africa (-5,040 mt), South America (-3,640 mt), and Central America (-230 mt).

October 2022 beef exports accounted for 13.1% of production and 15.3% when adding variety meats, compared to 12.4% and 14.3% in October 2021. January – October 2022 beef exports accounted for 13.2% of production and 15.4% when adding variety meats, compared to 12.8% and 15.0% for January – October 2021.

October beef export value per head of fed slaughter averaged $424.82/head, down 3% or -$14.63/head from $439.44/head in October 2021. January – October 2022 beef export value per head of fed slaughter averaged $459.50/head, up 17% or +$65.35/head from $394.15/head for January – October 2021.

Source: USMEF