American Beef Export Trade Stats: May 2021

Beef Highlights:

May 2021:

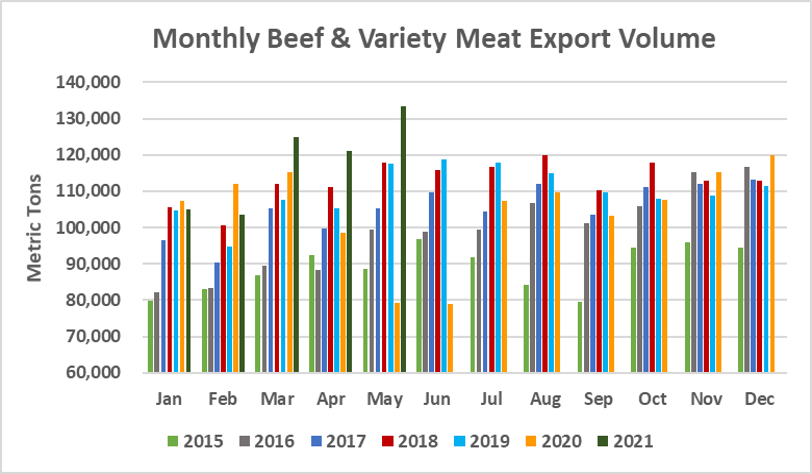

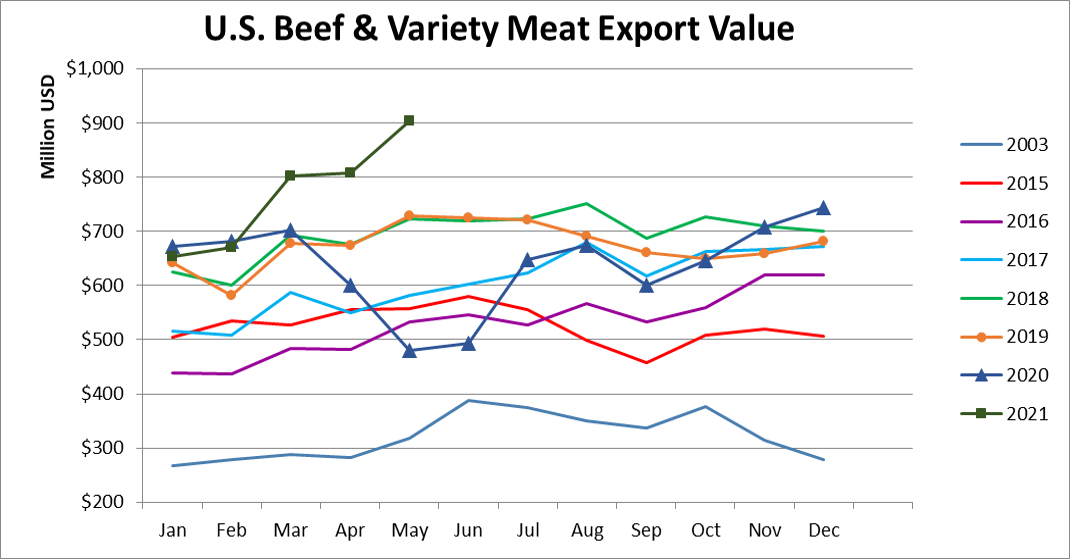

Beef: 105,093 mt, +69% and a new record, $813 million, +90% and a new record

BVM: 28,347 mt, +65% and the highest since 2019, $91 million, +72% and the second highest monthly value

Beef + BVM: 133,440 mt, +68% and a new record, $904 million, +88% and a new record

January – May 2021:

Beef: 462,663 mt, +17%, $3.440 billion, +24%

BVM: 125,175 mt, +6%, $397 million, +7%

Beef + BVM: 587,838 mt, +15%, $3.837 billion, +22%

Record month for beef exports to Korea; strong rebound in Japan and Taiwan

Beef export value equated to $433.18 per head of fed slaughter in May, up 53% from a year ago and breaking the previous record by more than $65. The January-May average was $361.29 per head, up 13%. Exports accounted for 17.6% of total May beef production and 14.9% for muscle cuts only, up dramatically from the year-ago ratios of 12.5% and 10.5%. January-May exports accounted for 15% of total production and 12.6% for muscle cuts, each about one full percentage point higher than a year ago.

Beef exports to South Korea were record-large in May at 29,403 mt, up 61% from a year ago, valued at $225.4 million (up 87%). This pushed January-May exports 20% above last year’s pace at 121,881 mt, with value up 27% to $912 million. Driven by excellent retail demand in both traditional venues and e-commerce, Korea is the leading value market for U.S. beef in 2021. Despite some COVID-related restrictions, Korea’s foodservice sector has also been a strong performer for U.S. beef. Through May, U.S. beef captured 66% of Korea’s chilled beef import market, up one percentage point from last year. Chilled volume was nearly 33,000 mt, up 21% from a year ago.

May exports to Japan, the top volume destination for U.S. beef, rebounded to 30,721 (up 54% from a year ago) valued at $208.3 million (up 71%). Exports were impacted in April by a higher safeguard tariff rate, which Japan imposed for 30 days. But in mid-April the safeguard rate expired and U.S. beef received its annual tariff reduction under the U.S.-Japan Trade Agreement, putting U.S. product back on a level playing field with major competitors, with beef muscle cuts tariffed at 25%. Through May, beef exports to Japan were still 2% below last year at 131,423 mt, but export value was up 3% to $864.2 million.

Beef exports to China totaled 16,472 mt in May, only slightly trailing the April record, valued at $130.2 million. With expanded beef access to China in place for more than one year under the Phase One Economic and Trade Agreement, exports to the world’s largest beef import market continue to climb. January-May exports to China reached 64,763 mt valued at $474.7 million – each up about 1,200% year-over-year and already establishing new annual records. The United States is now the largest supplier of grain-fed beef to China and accounted for 4.4% of China’s total beef imports in the first five months of the year.

Other January-May highlights for U.S. beef exports include:

Down by double digits in the first quarter, May exports of beef variety meat trended higher year-over-year for the second consecutive month at 28,347 mt (up 65% and the largest since 2019). May export value was $91.3 million, up 72% and the third highest on record. While the variety meat capture rate continues to be challenged by labor availability at the plant level, demand is strong in Latin America and Southeast Asia, with beef tongue and other variety meat exports to Japan also trending higher and a rebound in liver exports to Egypt. Through May, beef variety meat exports were 6% ahead of last year’s pace at 125,175 mt, valued at $396.8 million (up 7%).

After a slow start in 2021, beef exports to Taiwan continue to show improvement. May exports were the largest of the year at 5,648 mt (up 41% year-over-year), valued at $52.2 million (up 60%). Through May, exports to Taiwan remained 6% below last year at 23,502 mt, but export value increased 3% to $222 million.

Led by strong growth in Guatemala and Honduras and a near-doubling of shipments to El Salvador, beef exports to Central America increased 48% from a year ago to 8,401 mt, valued at $50.6 million (up 60%).

Beef exports to South America have made a strong comeback in 2021, led by growth in Chile and Colombia. Through May, exports to the region increased 24% from a year ago to 12,422 mt, valued at $63.3 million (up 52%).

May beef exports accounted for 14.9% of production and 17.6% when adding variety meats, as compared to 10.5% and 12.5% in May 2020. January – May 2021 beef exports accounted for 12.6% of production and 15.0% when adding variety meats, compared to 11.6% and 14.1% for January – May 2020.

May beef export value per head of fed slaughter averaged $433.18/head, up 53% or +$150.70/head from $282.48/head in May 2020. January – May 2021 beef export value per head of fed slaughter averaged $361.29/head, up 13% or +$42.42/head from $318.87/head for January – May 2020.

Source: USMEF