American Beef Export Trade Stats: January 2022

Beef Highlights:

January 2022:

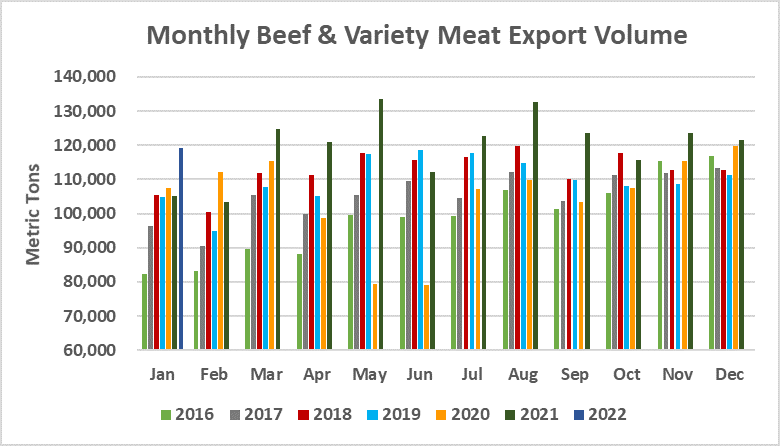

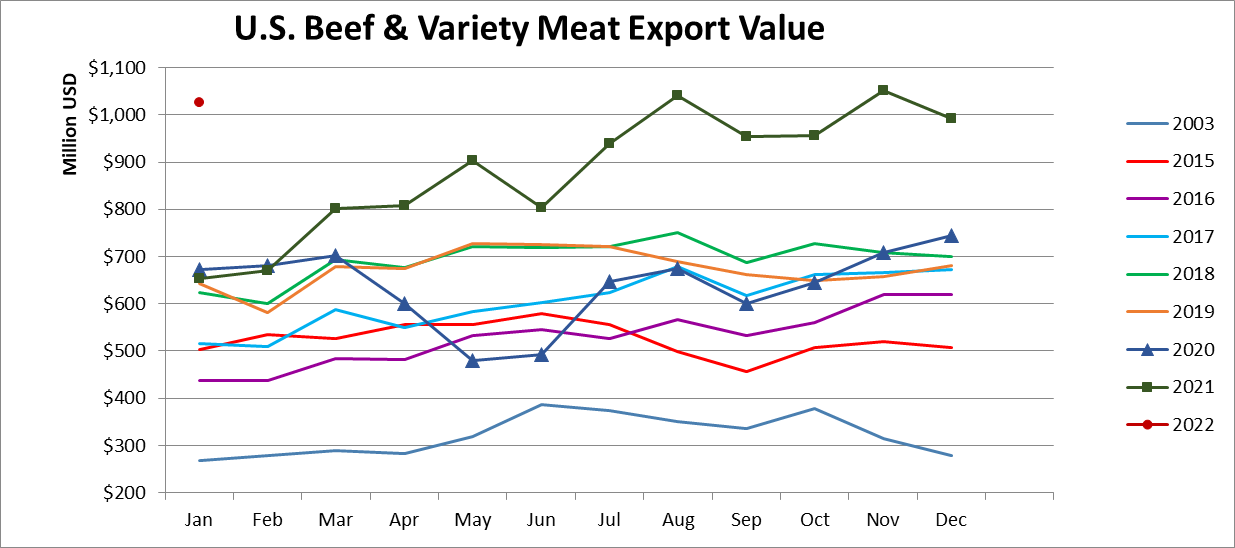

Beef: 96,089 mt, +18%, $933 million, +60% and the third highest value after August and November 2021

BVM: 22,977 mt, -3%, $93 million, +36%

Beef + BVM: 119,066 mt, +13%, $1.026 billion, +57% and third highest value after November and August 2021

January beef muscle cut exports totaled 96,089 mt, up 18% from last year (or +14,700 mt) and the sixth highest monthly volume on record, but steady with the average for Q4 2021. Export value was the third highest after August and November 2021 at $933 million, up 60% year-over-year. January beef muscle cut exports were higher than last year in volume to Korea (+8,100 mt), China/HK (+7,000 mt), Tawan (+3,050 mt), EU27 + UK (+800 mt), Caribbean + DR (+480 mt), Central America (+360 mt), ASEAN (+280 mt), Japan (+200 mt), South America (+190 mt), and the Middle East (+90 mt). Exports were lower year-over-year to Canada (-1,900 mt) and Mexico (-4,000 mt). Beef muscle cut exports to Korea (28,802 mt, +39%) were the second highest on record after the total last May of 28,886 mt. Exports to Japan (18,569 mt, +1%) were up slightly from last January but were also the lowest since that month. Combined exports to China/HK totaled 17,858 mt, up 64% year-over-year, but the lowest since last February and down 8% from the Q4 2020 average. Exports to China (16,156 mt, +115%) were down just 2% from the Q4 2020 pace, while exports to Hong Kong (1,702 mt, -50%) slowed to the lowest level in years. Exports to Taiwan (6,884 mt, +80%) were up sharply from last year’s low level (and up 32% from 2020) as volumes reached the second highest monthly total on record after 7,416 mt in August 2020. Exports slowed to both Canada (7,287 mt, -21%) and Mexico (6,487 mt, -38% and the lowest since September 2020). Exports to Colombia (812 mt, +68%) remained strong after the record month in December (of 1,621 mt) and reached the third highest monthly volume on record, while exports to Chile (358 mt, -26%) slowed. Exports were higher to Guatemala (768 mt, +60%) and the Dominican Republic (542 mt, +28%) but were lower to Costa Rica (384 mt, -18%). Exports were higher to Indonesia (705 mt, +51%) and Singapore (296 mt, +24%), and exports to Vietnam (681 mt, +71%) were the highest since March, but exports to the Philippines (483 mt, -41%) were the lowest since 2017. Exports continued to trend higher year-over-year to the UAE (568 mt, +7%) and Kuwait (458 mt, +33%). Exports continued to rebound to the Bahamas (258 mt, +58%) and to Jamaica (196 mt, +317%).

January beef variety meat exports totaled 22,977 mt, down 3% from last year and down 12% from 2020. Compared to last January, beef variety meat exports were higher year-over-year to China/HK (+1,100 mt), Japan (+720 mt), Mexico (+520 mt), and Korea (+160 mt), while exports were lower to Africa (-1,050 mt), South America (-730 mt), ASEAN (-650 mt), Canada (-380 mt), the Middle East (-180 mt), Central America (-140 mt), and the Caribbean + DR (-80 mt). Beef variety meat exports to Mexico (8,052 mt, +7%) were higher than last year but were down 9% from the Q4 2021 pace. Exports to Egypt (5,275 mt, -3%) rebounded to the highest level since last January. Exports to Japan (4,367 mt, +20%) were higher than last year and were similar to the Q4 2021 average. Combined exports to China/HK totaled 1,914 mt, up 133% from last year and steady with the Q4 2021 average. Exports to China (1,234 mt, +248%) were the second highest since the market reopened after the December total of 1,790 mt, while exports to Hong Kong (680 mt, +46%) were higher year-over-year but were lower than November and December. Apart from 1,128 mt the previous month, exports to Korea (776 mt, +25%) were the highest since October 2020. Exports to Indonesia (612 mt, -42%) rebounded from November and December but remained below year-ago levels, and exports to the Philippines (105 mt, -72%) also started to rebound and were the highest since August. Exports to Canada (357 mt, -51%) slowed to the lowest level in recent years. Exports to Gabon (295 mt, +134%) maintained the momentum that picked up in Q4 last year, but exports to South Africa (188 mt, -82%) slowed to the lowest level since April 2019, and exports were also lower to Angola (109 mt, -69%) and Cote d’Ivoire (54 mt, -49%). Exports to Honduras (166 mt, +337%) were the highest since 2018. Exports to Jamaica (124 mt, -9%) were the lowest since 2014. Exports to Chile (92 mt, -38%) were lower year-over-year for the second consecutive month, while exports to Peru (49 mt, -90%) were the lowest in recent years.

January beef exports accounted for 13.3% of production and 15.4% when adding variety meats, up from 11.0% and 13.3% for January 2021.

January beef export value per head of fed slaughter averaged a record $503.68/head, up 62% or +$191.92/head from $311.77/head in January 2021.

Source: USMEF