American Beef Export Trade Stats: August 2022

Beef Highlights

August 2022:

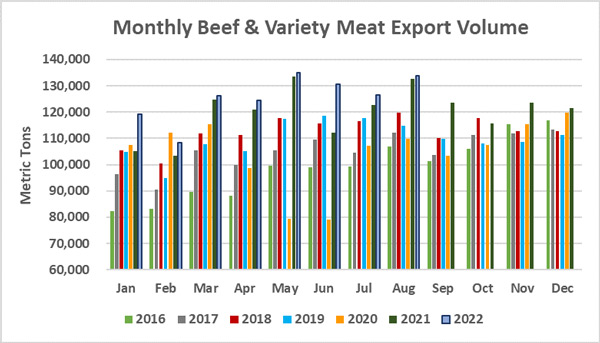

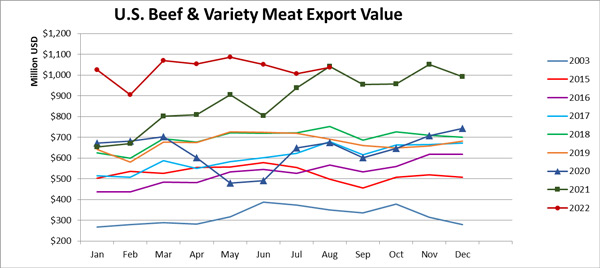

Beef: 107,714 mt, +0.4% and the highest ever recorded; $932 million, -1%

BVM: 26,118 mt, +3%; $104 million, +5%

Beef + BVM: 133,832 mt, +1% and the second highest after May 2022; $1.036 billion, -0.5%

January – August 2022:

Beef: 802,307 mt, +6%, $7.389 billion, +24%

BVM: 201,996 mt, +2%; $844 million, +27%

Beef + BVM: 1.004 million mt, +5%; $8.233 billion, +24%

August beef muscle cut exports totaled 107,714 mt, up 0.4% or +460 mt from last year and the highest monthly volume on record. Compared to last year, beef muscle cut exports were higher to China/HK (+2,270 mt), the Middle East (+1,120 mt), the Philippines (+1,070 mt), Canada (+950 mt), ASEAN (+880 mt), and EU27 + UK (+160 mt). Exports were lower to Japan (-2,250 mt), Mexico (-1,070 mt), Indonesia (-830 mt), South America (-630 mt), Taiwan (-440 mt), Central America (-320 mt), Korea (-150 mt), and Caribbean + DR (-70 mt). August beef muscle cut exports to China (23,581 mt, +18%) were the highest ever recorded, driven by record exports to China/HK (26,350 mt, +9%), while exports to Hong Kong (2,770 mt, -33%) were lower year-over-year, but were the highest since last November. For the month of August, China was the top value destination for U.S. beef muscle cut exports at $238 million (up 32% from last year), surpassing Korea at $213 million and Japan at $189 million. Exports slowed slightly compared to last year to Korea (23,770 mt, -1%) in August. Exports to the Middle East totaled 2,100 mt (+114%) led by the UAE (870 mt, +131%) which had the fifth highest exports on record after May 2011, March 2011, May 2022, and April 2011. Exports to Saudi Arabia (150 mt, +226%) were also higher year-over-year. Exports to the ASEAN region (4,750 mt, +23%) were higher than last year driven by the Philippines. August exports to the Philippines (1,890 mt, +131%) reached the third highest volume after April and June 2022. Through August, beef muscle cut export volume to the Philippines already surpassed the annual totals for 2020 and 2021 and is nearly surpassing the annual total for 2018 (which was the previous annual record). Exports to Indonesia (1,440 mt, -37%) slowed, while exports were higher to Vietnam (770 mt, +101%). Exports to Canada (8,950 mt, +12%) were the highest so far this year, while exports to Japan (22,000 mt, -9%) slowed to the lowest level since March. Exports to Mexico (7,970 mt, -12%) were lower year-over-year, but the second highest level this year. Exports to South America (890 mt, -42%) slowed to the lowest level since September 2020, and exports to Central America (1,150 mt, 022%) were the lowest since June 2021. Exports to the EU 27 + UK (1,690 mt, +10%) were higher year-over-year. Exports to Taiwan (6,000 mt, -7%) slowed in August. Exports also slowed to the Caribbean + DR (1,900 mt, -4%).

August beef variety meat exports totaled 26,118 mt, up 3% or +800 mt from last year. Exports were higher than last year to China/HK (+2,930 mt), Egypt (+1,500 mt), the Philippines (+750 mt), Korea (+410 mt), Colombia (+280 mt), Mexico (+220 mt), Africa (+60 mt), and South America (+30 mt). Exports were lower to Japan (-3,370 mt), Indonesia (-1,040 mt), Central America (-520 mt), ASEAN (-310 mt), Canada (-120 mt), Caribbean + DR (-40 mt). Combined exports to China/HK (4,460 mt, +191%) were the second highest since BSE after exports in May (4,690 mt). Exports to China (3,990 mt, +440%) were the highest ever recorded, but exports to Hong Kong (470 mt, -41%) slowed year-over-year. Exports were slightly higher than last year to top market Mexico (8,080 mt, +3%). Exports to Egypt (3,590 mt, +72%) were higher year-over-year, but exports slowed to Japan (3,960 mt, -46%). Exports to the Philippines (850 mt, +690%) were the third highest on record after August 2010 and June 2008. Exports to Korea (780 mt, +109%) and Colombia (370 mt, +278%) were higher year-over-year, while exports were lower to Indonesia (600 mt, -63%). Exports to Cote d’Ivoire (290 mt, +3%) were the highest since March 2020 and exports to Angola (210 mt, up from 0 mt) were the highest since May 2021, while exports to South Africa (510 mt, -5%) were lower year-over-year for the sixth consecutive month. Exports to South America (1,270 mt, +3%) were higher year-over-year, while exports to Central America (110 mt, -83%) were the lowest level since January 2014. Exports slowed to Peru (600 mt, -42%, but exports were higher than last year to Colombia (370 mt, +278%) and Chile (250 mt, +224%). Exports were lower year-over-year to the ASEAN region (1,460 mt, -17%), but were the highest since last August. Exports slowed to Canada (500 mt, -20%) and exports to Caribbean + DR (790 mt, -4%) slowed, but were the highest since last August.

January – August beef muscle cut + beef variety meat exports totaled 1.004 million mt, up 5% or +48,900 mt from last year. Exports were higher to China/HK (+39,160 mt), Korea (+7,790 mt), Taiwan (+6,230 mt), Middle East (+6,000 mt), EU 27 + UK (+5,540 mt), Caribbean + DR (3,880 mt), ASEAN (+3,390 mt), Canada (+1,230 mt), and Central America (+610 mt). Exports were lower to Mexico (-14,990 mt), Africa (-4,590 mt), Japan (-4,210 mt), and South America (-1,100 mt).

August 2022 beef exports accounted for 13.4% of production and 15.6% when adding variety meats, compared to 14.2% and 16.4% in August 2021. January – August 2022 beef exports accounted for 13.3% of production and 15.5% when adding variety meats, compared to 12.8% and 15.0% for January – August 2021.

August beef export value per head of fed slaughter averaged $437.98/head, down 7% or -$30.75/head from $468.72/head in August 2021. January – August 2022 beef export value per head of fed slaughter averaged $471.18/head, up 23% or +$89.27/head from $381.90/head for January – August 2021.

Source: USMEF