American Beef Export Trade Stats: April 2021

Beef Highlights:

April 2021:

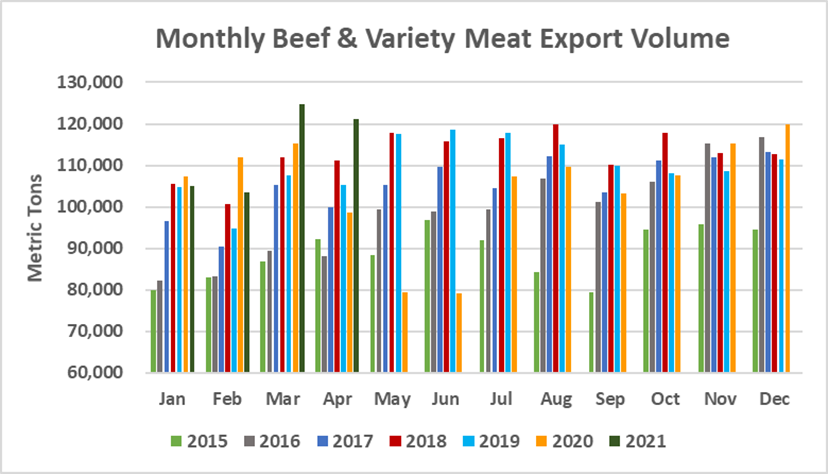

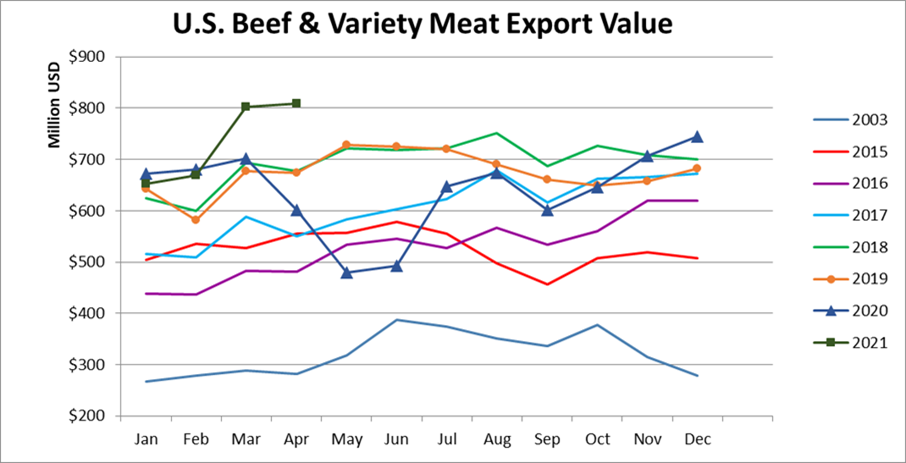

Beef: 94,656 mt, +21% and the third highest monthly volume, $727 million, +36% and a new record

BVM: 26,394 mt, +29% and the highest since last March, $82 million, +22%

Beef + BVM: 121,050 mt, +23% and the fifth highest monthly volume, $808 million, +35% and a new record

January – April 2021:

Beef: 357,570 mt, +8%, $2.627 billion, +12%

BVM: 98,828 mt, -4%, $305 million, -4%

Beef + BVM: 454,398 mt, +5%, $2.933 billion, +10%

In April, beef muscle cut export volume was the third highest on record at 94,656 mt, up 21% or +16,570 mt from last year and up 17% from April 2019. Beef muscle cut export value set a new record at $727 million. April exports were higher to China/HK (+12,800 mt), Korea (+4,400 mt), Mexico (+4,200 mt), Central America (+970 mt), ASEAN (+840 mt), Caribbean + DR (+720 mt), Middle East (+690 mt), EU 27 + UK (+490 mt), South America (+470 mt), and Taiwan (+220 mt), while exports were lower to Japan (-7,200 mt) and Canada (-2,100 mt). Korea (23,063 mt, +23%) was the top muscle cut destination in April, and it was the third consecutive month that exports were over 23,000 mt (and value set a new record in April at $181 million). Exports to Japan (20,484 mt, -26%) were down from last April’s large volume but were up 7% from 2019. Combined exports to China/HK set a new monthly record at 19,457 mt, +192%, driven by a new record to China (16,352 mt, +1,138% and up from the previous record of 14,188 mt in March) as exports to Hong Kong (3,105 mt, -42%) were the lowest since 2012. Exports to Mexico (8,664 mt, +94%) slowed from 9,485 mt in March and were similar to Feb levels, and while exports were up sharply from last year’s low levels, they were down 27% from April 2019. Exports to Canada (7,896 mt, -21%) were down from last year’s large total but were the highest since January and were up 11% from April 2019. April beef muscle cuts to Taiwan (5,311 mt, +4%) were the highest since October. Exports slowed from March to April but were higher year-over-year to the Philippines (1,091 mt, +73%), Indonesia (751 mt, +186%), and Singapore (289 mt, +51%), while exports were lower to Vietnam (602 mt, -29%). Exports to Colombia (447 mt, +402%) maintained momentum and reached the fifth highest monthly volume in April, while exports to Chile (634 mt, -2%) were slightly lower year-over-year. Exports to Guatemala (584 mt, +78%) remained strong, and exports to Costa Rica (463 mt, +205%) reached the second highest monthly volume after January. Exports have been rebounding to the Dominican Republic (433 mt, +376%) and Bahamas (254 mt, +70%), but April exports were down 28% from 2019 for the DR and down 18% for the Bahamas. Exports to Kuwait (442 mt, +225%) were the highest since November (and otherwise the highest since 2011), and exports to Qatar (209 mt, +190%) were the highest since 2011, but exports slowed from recent months to the United Arab Emirates (422 mt, +128%).

In April, beef variety meat exports rebounded to the highest level since last March (when exports were 27,600 mt before the pandemic) at 26,394 mt, up 5,868 mt or up 29% from last year. Beef variety meat exports were higher year-over-year to Mexico (+2,850 mt), Japan (+1,200 mt), the ASEAN (+920 mt), Africa (+680 mt), South America (+410 mt), Middle East (+260 mt), and Central America (+230 mt), but exports were lower to Korea (-310 mt), China/HK (-160 mt), Canada (-130 mt), and the Caribbean + DR (-40 mt). Exports to Mexico (8,526 mt, +50%) were the highest since December and were up 16% from 2019. Apart from March, April exports to Japan (4,809 mt, +34%) were the highest since 2019. Exports to Egypt (3,429 mt, +7%) have been slow since February, and in April, exports were up 7% from last year but down 28% from 2019. April exports to South Africa (+2,400 mt, +63%) reached the second highest monthly volume after 2,530 mt in June 2017. Exports to Cote d’Ivoire (263 mt, -9%) were the highest since September, and to Gabon (215 mt, -21%) were the highest since August, but exports to Angola (155 mt, -62%) slowed from March to April. Exports to Indonesia (1,293 mt, +83%) were the highest since 2019, but while exports to the Philippines (434 mt, +265%) were up year-over-year, they were down 11% from 2019. Combined exports to China/HK totaled 1,435 mt, down 10% year-over-year. Exports were the highest since the market reopened to China (881 mt, +1,815%), but exports slowed to Hong Kong (554 mt, -64%). Exports were lower to Canada (713 mt, -15%) and Korea (419 mt, -43%). Exports to Peru (628 mt, +19%) slowed from March but were otherwise the highest since last September, while exports to Chile (341 mt, +75%) were the highest since 2017, and exports to Colombia (290 mt, +78%) maintained momentum. Exports remained slow to Jamaica (167 mt, -47%), but exports to Trinidad and Tobago (115 mt, +229%) were the highest since September.

January – April beef and variety meat exports totaled 454,398 mt, up 5% or +21,100 mt from last year. Exports were higher year-over-year to China/HK (+40,300 mt), Korea (+9,100 mt), Central America (+2,100 mt), South America (+1,100 mt), and the ASEAN (+50 mt), while exports were lower to Japan (-13,450 mt), Canada (-5,400 mt), Taiwan (-3,020 mt), Middle East (-2,300 mt), Africa (-2,200 mt), Caribbean + DR (-2,050 mt), EU 27 + UK (-1,700 mt), Mexico (-1,300 mt), and the surrounding Russia region (-70 mt).

April beef exports accounted for 12.6% of production and 15.0% when adding variety meats, as compared to 13.5% and 15.9% in April 2020 (when production dropped 20% from the previous year). January – April 2021 beef exports accounted for 12.1% of production and 14.4% when adding variety meats, compared to 11.9% and 14.4% for January – April 2020.

April beef export value per head of fed slaughter averaged $367.45/head, a new record and up 1% or +$4.10/head from $363.65/head in April 2020. January – April beef export value per head of fed slaughter averaged $343.70/head, up 5% or +$17.23/head from $326.47/head for January – April 2020.

Source: USMEF