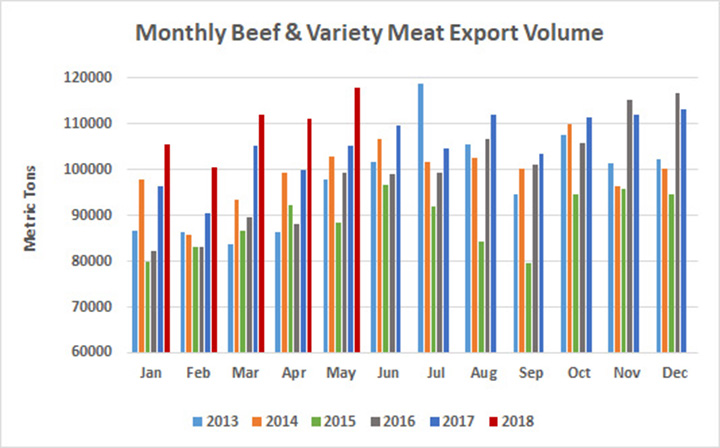

US beef export statistics: May 2018

Beef Highlights:

May:

Beef Exports: 89,822 mt, +20%, $643 million, +28%

BVM Exports: 28,047 mt, -7%, $78 million, +1%

Beef + BVM Exports: 117,869 mt, +12%, $722 million, +24%

Jan – May:

Beef Exports: 413,900 mt, +14%, $2.949 billion, +23%

BVM Exports: 133,255 mt, +0%, $367 million, +5%

Beef + BVM Exports: 547,155 mt, +10%, $3.316 billion, +21%

At 117,869 mt, beef/bvm exports were the second largest for the month of May after 2000. Overall, exports were the sixth largest monthly volume on record. Muscle cut exports were the second largest monthly volume on record after July 2011.

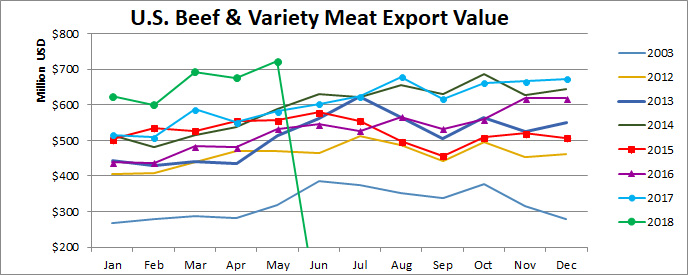

Beef/bvm export value set a new record in May, exceeding $700 million for the first time (at $722 million). Beef/bvm export value was up 4% from the previous record from this March of $693 million. Beef muscle cut export value was also record large in May at $643 million, up 4% from the previous record of $618 million in March of this year. Compared to last May, beef muscle cut export value was up $139 million, with Korea accounting for 40.5% of the increase, with export value to Korea up $56 million from last year to $141 million. Exports were up $38 million to Japan, $20 million to China/HK (+$7 million just for China), and $13 million to Taiwan compared to last year. Year to date, beef muscle cut export value was up $552 million from last year, with the Asian markets driving the increase. Export value to Korea was up $209 million, China/HK +$128 million (+$28 million just to China), Japan +$110 million, and Taiwan +$63 million.

Japan was the largest market for beef muscle cut exports, with exports of 25,735 mt, up 21% or +4,500 mt from last May and the highest since last August. Exports to Korea had the largest year-over-year growth at 19,735 mt, +50% or +6,600 mt, and were the highest monthly exports since March 2011. Other top volume growth markets in May were Canada (9,875 mt, +26% or +2,000 mt) and Taiwan (4,625 mt, +35% or +1,200 mt). Exports were also higher to Mexico (11,632 mt, +5%), China/HK (9,052 mt, +4%), the Middle East (1,209 mt, +30%), the Caribbean + DR (1,663 mt, +6%), and Central America (925 mt, +31%). Exports to China were 828 mt in May, the highest since the market opened, while exports to HK slowed to the lowest level so far this year at 8,224 mt, -6% year-over-year. Exports were lower to the ASEAN (2,528 mt, -11%), the EU (1,444 mt, -26%), and South America (1,179 mt, -12%). In the ASEAN, higher exports to the Philippines (1,016 mt, +37%) were offset by lower exports to Vietnam (647 mt, -36%). Exports to Chile were at their lowest level since 2011 in March and April. Exports to Chile rebounded somewhat in May, but were still 21% below year-ago levels at 692 mt.

BVM exports were down year-over-year in May, driven by lower exports to the Middle East (4,042 mt, -18%), the ASEAN (1,079 mt, -47%), Mexico (8,833 mt, -9%), South America (1,371 mt, -35%), and Africa (2,267 mt, -9%). Exports to Egypt dropped to their lowest level since last October at 4,942 mt, down 1,000 mt or -16% from last May’s low level. Exports to Egypt had picked up from last year’s pace in Feb and Mar at over 7,000 mt each month, before exports began to slow again in April. Mexico is the top market for U.S. bvm exports, and exports were down 850 mt from last May. Exports were higher to the Philippines in May (537 mt, +46%), but exports to Indonesia were down over 1,000 mt from last May (541 mt, -67%). BVM exports to Peru have been sluggish compared to last year and were down 26% in May at 707 mt. After slowing from last fall through early 2018, bvm exports to South Africa were the second highest since the market opened at 1,862 mt, +17%, but exports were lower to Africa as volumes have trailed off to the Ivory Coast, and exports were lower to Angola and Gabon. BVM exports were higher to Japan (4,382 mt, +6%) and China/HK (2,091 mt, +33%). BVM exports to HK were 2,085 mt, +33% and the third highest on record after April and May 2000. BVM exports were also more than double to the Caribbean at 809 mt. The growth to the Caribbean was driven by larger exports to Jamaica. Exports to Jamaica were 565 mt, +209% and the largest since December 2011.

For Jan – May, beef/bvm exports were up 49,800 mt with higher exports to Korea (+23,200 mt), China/HK (+9,500 mt), Taiwan (+5,200 mt), Japan (+4,900 mt), Mexico (+3,500 mt), the ASEAN (+2,600 mt), the Middle East (+1,400 mt), Central America (+940 mt), the Caribbean + DR (+830 mt), South America (+490 mt), and Canada (+110 mt). Exports were lower to the EU (-2,500 mt), Africa (-340 mt), and the Russia Region (-40 mt).

May beef exports accounted for 11.1% of production and 13.6% when adding variety meats, up from 10.0% and 13.0% in May 2017. For Jan – May, beef exports accounted for 10.9% of production and 13.5% when adding variety meats up from 10.0% and 12.8% last year.

May beef export value per head of fed slaughter averaged $313.39/head, up $47.84/head or 18% from $265.55/head last May. Jan – May beef export value per head averaged $317.69/head up $47.42/head or 18% from $270.27/head last year.

SOURCE: USMEF