American Beef Export Trade Stats: September 2019

Beef Highlights:

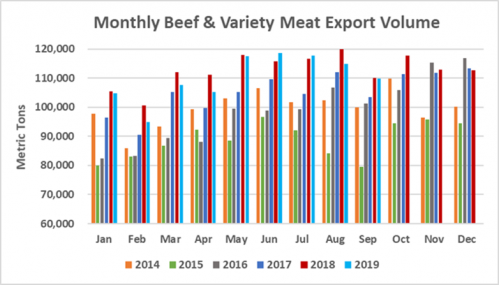

September 2019:

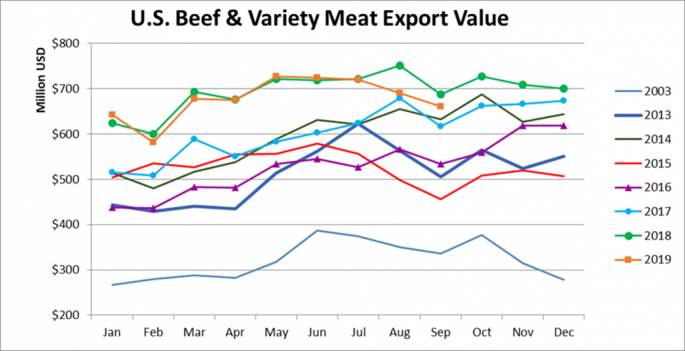

Beef : 83,725 mt, -2%, $580 million -5%

BVM: 26,074 mt, +6%, $81 million, +9%

Beef + BVM: 109,799 mt, -0.3%, $661 million, -4%

January – September 2019:

Beef: 749,888 mt, -4%, $5.383 billion, -3%

BVM: 241,437 mt, +4%, $718 million, +10%

Beef + BVM: 991,325 mt, -2%, $6.100 billion, -2%

In September, beef muscle cut exports were down just 2,000 mt from last year, with higher exports to Korea (+2,400 mt), the ASEAN (+2,300 mt), Central America (+490 mt), Taiwan (+470 mt), Africa (+70 mt), the Middle East (+70 mt), and the Caribbean + DR (+20 mt). Exports were lower to Japan (-3,600 mt), Mexico (-1,800 mt), China/HK (-1,100 mt), Canada (-800 mt), the EU (-80 mt), and the Russia region (-10 mt). Korea again surpassed Japan as the largest beef muscle cut destination, with exports to Korea up 13% to 20,333 mt, while exports to Japan were down 15% to 19,595 mt. Exports were lower to Mexico (10446 mt, -15%) and Canada (7,433 mt, -10%). Exports to the China/HK region were the highest since last December but were down 13% year-over-year at 7,517 mt. Exports to HK (6,264) were the highest since last December but were down 23% year-over-year, and exports to China (1,253 mt, +139%) were the largest since the market opened (surpassing the previous record of 888 mt in July). Export growth to Asia continued in September: Taiwan (5,082 mt, +10%), Vietnam (1,828 mt, +19% and the highest since 2012), Philippines (1,799 mt, +61% and a new record), Indonesia (1,707 mt, +204% and a new record), and Singapore (269 mt +31%). In Central America, exports were higher to Guatemala (566 mt, +66%), Dominican Republic (487 mt, +5%), and Panama (345 mt, +143% and the highest since 2014). In South America, exports slowed to Chile (477 mt, -41%) but were higher to Colombia (208 mt, +37%).

BVM exports were above year-ago levels for the fourth consecutive month in September. Total bvm exports were up 1,400 mt in September, with higher exports for top markets Mexico (+1,800 mt) and the Middle East (+1,700 mt). Exports were also higher to the ASEAN (+290 mt), but were lower year-over-year to most other destinations including Africa (-1,100 mt), China/HK (-580 mt), Japan (-460 mt), and South America (-60 mt). Although down from August’s volume, exports to Mexico were the second highest this year at 9,018 mt, up 26% year-over-year. Value to Mexico was up 51%. Exports to Egypt totaled 5,350 in September, up 48% from last year’s low level. Exports were lower to Japan (4,446 mt, -9% and the lowest since February) and Korea (934 mt, -22%), and exports were flat to Canada at 771 mt. In the ASEAN region, Indonesia (1,069 mt, +99%) continued to see strong growth with exports over 1,000 mt each month since June, but exports were lower to the Philippines (236 mt, -44%). Exports to South Africa (948 mt, -24%) were up from 780 mt in August, but apart from July, export volumes have been lower than the summer highs for the past two years, and exports were also lower to Angola (266 mt, -44%). Exports to Hong Kong (853 mt, -40%) slowed to the lowest level since last January. In South America, exports were lower to Peru (533 mt, -15%) but were higher to Colombia (262 mt, +9%) and Chile (199 mt, +103%). Exports to Jamaica (275 mt, +9%) were the lowest so far this year but were above year-ago levels.

For January – September, total beef and bvm exports were down 18,100 mt from last year as higher exports to Korea (+15,100 mt), the ASEAN (+10,600 mt), Taiwan (+4,300 mt), the Caribbean + DR (+1,900 mt), the Middle East (+1,300 mt), Central America (+850 mt), and the Russia region (+50 mt) were outweighed by lower exports to China/HK (-21,000 mt), Canada (-12,300 mt), Japan (-11,100 mt), Africa (-3,300 mt), the EU (-2,200 mt), Mexico (-1,900 mt), and South America (-200 mt).

September beef exports accounted for 11.9% of production and 14.6% when adding variety meats, as compared to 12.4% and 14.8% in September 2018. For January – September, beef exports accounted for 11.6% of production and 14.3% when adding variety meats, down from 12.1% and 14.6% last year.

September beef export value per head of fed slaughter averaged $318.54/head, down $16.07/head or -5% from $334.61/head for September 2018. For January – September, beef export value per head averaged $310.77/head, down $10.08/head or -3% from $320.85/head last year.

SOURCE: USMEF