American Beef Export Trade Stats: November 2019

Beef Highlights

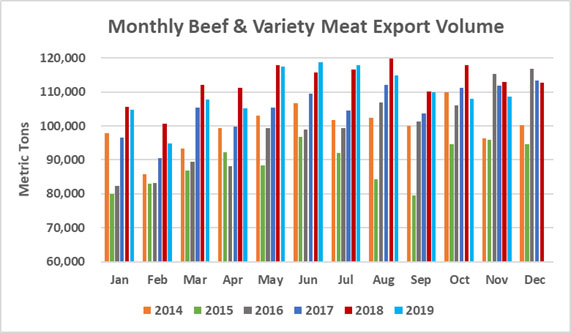

November 2019:

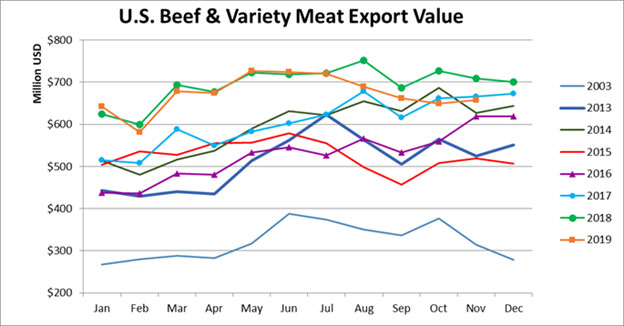

Beef : 80,874 mt, -8%, $569 million -10%

BVM: 27,788 mt, +12%, $89 million, +14%

Beef + BVM: 108,662 mt, -4%, $658 million, -7%

January – November 2019:

Beef: 912,477 mt, -5%, $6.522 billion, -4%

BVM: 295,527 mt, +4%, $886 million, +9%

Beef + BVM: 1.208 million mt, -3%, $7.408 billion, -3%

Beef muscle cut exports continued to lag 2018’s record volumes in November. Beef exports totaled 80,874 mt, down 8% or -7,100 mt from last November and were the lowest since April. In November, exports were higher to China/HK (+1,100 mt), Taiwan (+400), the EU (+180 mt), South America (+160 mt), Central America (+100 mt), and the Middle East (+40 mt). Exports were lower to Japan (-3,200 mt), Mexico (-1,950 mt), the ASEAN (-1,500 mt), Canada (-1,200 mt), Korea (-1,000 mt), and the Caribbean + DR (-210 mt). Exports to Japan (19,190 mt) rebounded from the low level in October (16,946 mt) but were down 14% from last year with export volumes expected to gain momentum in January following the Jan 1 implementation of the U.S.-Japan Trade Agreement. Exports to Korea (17,798 mt) slowed to the lowest level since February and were down 5% from last year. Exports to China/Hong Kong totaled 12,282 mt, the highest since last December and up 10% from last year. Exports to HK were also the highest since last December at 11,254 mt, up 10% year-over-year. Exports to China were the second highest since the market re-opened at 1,028 mt (following the high of 1,253 mt in September) and were up 18% from last year. Monthly exports to Mexico have been lower than last year since June, and in November, exports were 9,654 mt, down 17% from last year and the lowest since February 2017. Shipments to Canada also remained sluggish and totaled 7,443 mt, down 14% from last year. Exports to Taiwan maintained momentum and were up 9% from last year at 4,867 mt (bringing the Jan – Nov total to 57,809 mt compared to the 2018 annual record of 59,640 mt, 2019 will be the fourth consecutive record year). Exports were lower year-over-year to top destinations in the ASEAN: Philippines (745 mt, -38% and the lowest since last April), Vietnam (1,032 mt, -37%), Indonesia (652 mt, -37%), and Singapore (280 mt, -31%) –although Jan – Nov 2019 exports have already surpassed previous annual exports for the Philippines, Indonesia, and Singapore. November exports to Thailand set a monthly record at 177 mt, up +88%, and Jan – Nov exports are record large at 1,306 mt. For South America, November exports were higher for top markets Chile (905 mt, +38%) and Colombia (383 mt, +7%). Exports to Colombia already surpassed last year’s record of 3,266 mt at 3,506 mt through November. Exports to Guatemala with also be record large in 2019, with exports of 465 mt, +27% in November. Exports to the DR slowed in October and November and were 401 mt in November, down 26% from last year. November exports were steady to the Bahamas (299 mt) and were higher to the Netherlands Antilles (308 mt, +52% and record high). For the Middle East, exports were lower to the top two muscle cut markets: UAE (477 mt, -7%) and Kuwait (140 mt, -54%).

November bvm exports were up 12% or +2,900 mt from last November as higher exports to the Middle East (+2,000 mt), Mexico (+1,200 mt), Africa (+1,100 mt), Japan (+500 mt), Canada (+100 mt), the ASEAN (+100 mt), and Korea (+10 mt) outweighed lower exports to China/HK (-1,000 mt), South America (-530 mt), Central America (-390 mt), and the Caribbean + DR (-70 mt). Exports to Mexico were the lowest since July but were up 16% from last year at 8,878 mt. Exports to Egypt were 5,699 mt, up 53% from last November’s low total (of just 3,722 mt, one of the lowest monthly totals in the last 10 years), and 2019 total exports will end the year higher than 2018, but will remain lower than all other recent years. BVM exports have been higher year-over-year to Japan for all months so far in 2019 except September and October. In November, exports were 4,846 mt, up 11% from last year. November exports to Korea were up slightly from last year (1,318 mt, +1%) and were the highest since last December, and exports to Canada were the highest since last June (936 mt, +16%). Exports were also higher to Angola (670 mt, +538%) and Mozambique (102 mt, +325%) but were lower to Cote d’Ivoire (156 mt, -21%) and Gabon (131 mt, -56%). Exports to HK were the highest since June at 956 mt, but were down 51% from last year. BVM exports to Indonesia were below 1,000 mt for the first time since May at 957 mt in November but were still up 76% from last year, while exports to the Philippines slowed to the lowest level since November 2017 at 149 mt, -68%. Exports to Peru were the lowest since February (265 mt, -63%), while exports were higher year-over-year to Colombia (306 mt, +24%) and Chile (155 mt, +3% and up from just 5 mt in Oct).

For January – November, total beef and bvm exports were down 32,100 mt from last year as higher exports to Korea (+13,500 mt), the ASEAN (+10,600 mt), Taiwan (+4,200 mt), the Middle East (+2,700 mt), the Caribbean + DR (+1,600 mt), and Central America (+590 mt) were outweighed by lower exports to China/HK (-23,100 mt), Japan (-19,500 mt), Canada (-13,900 mt), Mexico (-3,300 mt), the EU (-2,400 mt), Africa (-2,150 mt), and South America (-850 mt). After strong exports in October (1,234 mt), exports to South Africa were strong again in November at 1,322 mt, up 92% from last year.

November beef exports accounted for 11.0% of production and 13.7% when adding variety meats, as compared to 11.8% and 14.1% in November 2018. For January – November, beef exports accounted for 11.4% of production and 14.1% when adding variety meats, down from 12.0% and 14.5% last year.

November beef export value per head of fed slaughter averaged $307.55/head, down $15.43/head or -5% from $322.97/head for November 2018. For January – November, beef export value per head averaged $308.74/head, down $11.99/head or -4% from $320.72/head last year.

SOURCE: USMEF