American Beef Export Trade Stats: July 2019

Beef Highlights

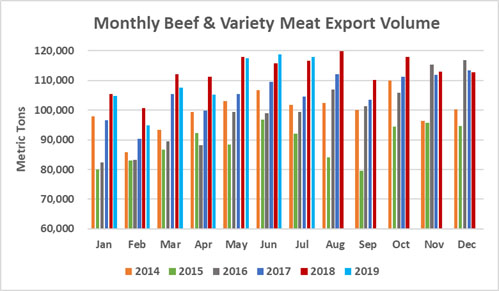

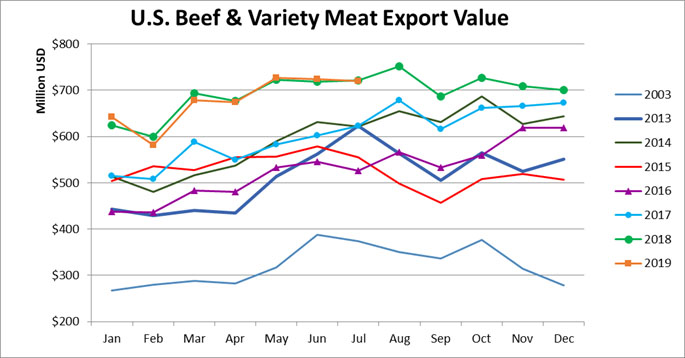

July 2019:

Beef : 89,711 mt, -3%, $639 million -2%

BVM: 28,131 mt, +16%, $81 million, +21%

Beef + BVM: 117,842 mt, +1%, $720 million, -0.2%

January – July 2019:

Beef: 580,010 mt, -3%, $4.195 billion, -1%

BVM: 186,597 mt, +2%, $554 million, +10%

Beef + BVM: 766,607 mt, -2%, $4.749 billion, -0.2%

July beef muscle cut exports were down 3% or -2,700 mt from last year as higher exports to Korea (+1,500 mt), China/HK (+580 mt), the ASEAN (+330 mt), the Middle East (+230 mt), South America (+90 mt), the EU (+80 mt), and Africa (+30 mt) were outweighed by lower exports to Japan (-2,900 mt), Canada (-1,600 mt), Mexico (-520 mt), the Caribbean + DR (-230 mt), Taiwan (-170 mt), and Central America (-120 mt). Korea surpassed Japan as the top beef muscle cut export destination for the third time this year, with exports to Korea at 24,192 mt, up 6% from last year and a new monthly record. Exports to Japan totaled 24,113 mt, down 11% from last year, but the second highest monthly volume so far this year after May. Beef exports to Mexico were the highest since last October but were down 4% year-over-year at 12,615 mt, while exports to Canada were down 17% from last year at 7,705 mt. After the record volume of 6,600 mt in June, exports to Taiwan slowed to 5,469 mt in July, down 3% from last year. Exports to China/HK combined totaled 6,152 mt, up 10% from last year but below the May and June volumes. Exports to Hong Kong were 5,246 mt, up 3%, while exports to China were 888 mt, up 89% and the highest since the market opened. For South America, beef exports to Chile (1,115 mt, +26% year-over-year) were the highest since February of last year, while exports to Colombia (283 mt, -4%) slowed. The ASEAN region continues to be the third largest growth driver so far this year after Korea and Taiwan, and in July exports were higher to Indonesia (879 mt, +152%) and Singapore (248 mt, +59%) but were lower to the Philippines (936 mt, -13%) and Vietnam (778 mt, -18%). Exports to the DR were down 5% to 607 mt, while exports to the Bahamas were up 8% to 323 mt. This year, exports to Guatemala, the top market in Central America, have slowed from last year’s record pace, and in July, exports were 353 mt, down 31% from last year. For the Middle East, beef exports were higher to top markets the UAE (338 mt, +10%) and Kuwait (278 mt, +148%).

Like June, BVM exports were above year ago levels in July. In July, BVM exports were up 4,000 mt from last year with higher exports to Japan (+2,200 mt), Mexico (+1,300 mt), the ASEAN (+970), Africa (+340 mt), the Caribbean + DR (+310 mt), and South America (+130 mt). BVM exports were lower to China/HK (-470 mt), the Middle East (-390 mt), and Canada (-340 mt). Exports to top destination Mexico were the highest since January at 8,181 mt, +19%. BVM exports to Japan were the highest since BSE for the second consecutive month at 7,100 mt, up 46% in July. After being above year-ago levels in May and June, BVM exports to Egypt dropped to the lowest level since last November at 4,151 mt, -9% in July. After lagging earlier in the year, BVM exports to South Africa seasonally increased in the summer months, with exports in July at 1,879 mt, up 39% and the third highest monthly volume (after 2,530 mt in June 2017 and 1,975 mt in June 2018). Exports to Angola, the second largest U.S. BVM market in Africa, were down 8% from last year at 198 mt. For the ASEAN, exports to Indonesia (1,528 mt, +218%) were the highest since May 2017, while exports were lower for the Philippines (472 mt, -11%). Exports to HK (790 mt, -37%) were the lowest since January 2018, and exports to Korea (912 mt, +3%) were the lowest since last July. Exports to Canada were also lower (575 mt, -37%). For South America, exports to Peru (729 mt, +5%) were the highest since September 2017 and exports to Colombia (431 mt, +56%) were the highest since October 2017, while exports to Chile (104 mt, -39%) were lower. Exports to Jamaica were higher (383 mt, +58%).

For January – July, total beef and bvm exports were down 12,800 mt from last year as higher exports to Korea (+15,100 mt), the ASEAN (+6,200 mt), Taiwan (+4,100 mt), the Caribbean + DR (+1,700 mt) and steady exports to South America (+50 mt) were outweighed by lower exports to China/HK (-18,800 mt), Canada (-11,500 mt), Mexico (-2,200 mt), Africa (-2,200 mt), Japan (-2,200 mt), the EU (-1,900 mt), the Middle East (-900 mt), and Central America (-100 mt).

July beef exports accounted for 11.8% of production and 14.4% when adding variety meats, as compared to 12.9% and 15.1% in July 2018. For January – July, beef exports accounted for 11.6% of production and 14.2% when adding variety meats, down from 12.1% and 14.7% last year.

July beef export value per head of fed slaughter averaged $308.47/head, down $22.18/head or -7% from $330.65/head for July 2018. For January – July, beef export value per head averaged $311.51/head, down $7.44/head or -2% from $318.95/head last year.

SOURCE: USMEF