American Beef Export Trade Stats: January 2019

Beef Highlights:

Jan 2019:

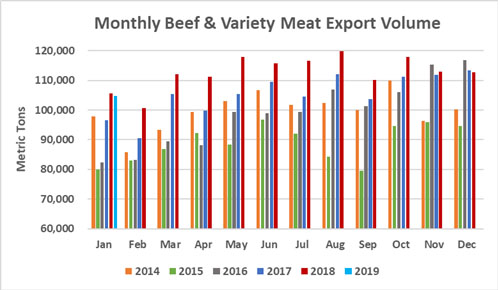

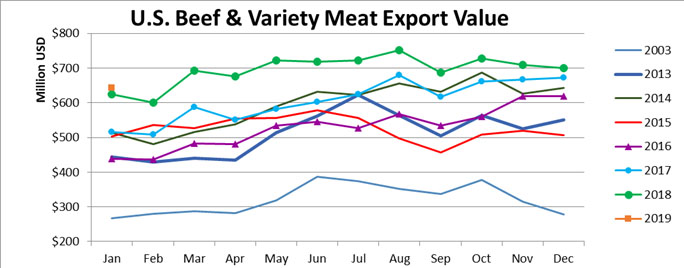

Beef: 78,136 mt, -3%, $560 million, +1%

BVM: 26,630 mt, +7%, $82 million, +19%

Beef + BVM: 104,766 mt, -1%, $642 million, +3%

Beef exports started the year down 3% from last year’s pace with higher January beef muscle cut exports for Mexico (+1,710 mt), Japan (+730 mt), Korea (+550 mt), the ASEAN (+530 mt), the Caribbean + DR (+260 mt), Central America (+90 mt), and the Middle East (+50 mt) outweighed by lower exports to China/HK (-4,510 mt), South America (-1,070 mt), Canada (-590 mt), and Africa (-100 mt). Exports were down just slightly to the EU, and exports to Taiwan were steady with last January. Exports to the top two destinations Japan and Korea were the highest since pre-BSE for the month of January at 21,280 mt, +4% and 16,586 mt, +3%, respectively. Exports to Mexico continued to rebound (and have now been above previous-year levels each month since last April) at 12,532 mt, up 16%, while exports to Canada lower at 8,260 mt, -7%. In January, exports to HK slowed to 5,744 mt, the lowest level since last July/August, and down 44% from last Jan. Exports to China were 800 mt, compared to 803 mt last Jan. Exports to Taiwan were steady with last year at 4,215 mt. Growth to the ASEAN region was led by the Philippines and Vietnam. Exports to the Philippines were 1,272 mt, up 51% from last year and the 5th highest monthly volume on record. Exports to Vietnam were 482 mt, up 18%. Exports to the DR were the highest for the month of January at 532 mt, up 54% from last year. In the Caribbean region, exports were higher to Jamaica (220 mt, +112%), Netherlands Antilles (202 mt, +13%), and the Leeward-Windward Islands (142 mt, +103%), while exports were lower to the Bahamas (216 mt, -25%). In Central America, exports were lower to Guatemala (465 mt, -9%), but were significantly higher to Costa Rica (310 mt, +179% and the third highest monthly volume on record). Exports to Chile were down 63% to 647 mt (down from high levels in Jan – Feb of last year, but more in line with exports from Mar – Dec 2018).

January BVM exports were higher to most regions including Japan (+1,230 mt), the ASEAN (+1,000 mt), Africa (+870 mt), China/HK (+610 mt), Central America (+340 mt), Korea (+210 mt), South America (+50 mt), and the Caribbean + DR (+50 mt). Exports were lower to Mexico (-1,660), the Middle East (-790 mt), and Canada (-290 mt). Exports to Mexico were down 16% at 8,662 mt, and exports to Egypt were down 15% at 4,548 mt (compared to 5,340 mt last year, 7,820 mt in 2017, 7,258 mt in 2016, and higher volumes from 2012 – 2015). Exports to Japan were up 36% from last year at 4,645 mt. Exports to the ASEAN were nearly all to Indonesia (1,343 mt, up 135% from last year and the highest since May 2017) and the Philippines (563 mt, +90%). South Africa was the top destination in Africa with exports at 508 mt, up 97% from last year, but seasonally slowing in Jan. The other top BVM markets in Africa in January were Gabon (452 mt, +503% and the highest since 2015), Angola (283 mt, -7%), Mozambique (220 mt, +323% and the highest since 2017), and Guinea (122 mt, +198% and the highest on record). Exports to Korea were up 19% at 1,314 mt and exports to HK were up 88% at 1,303 mt, while exports to Canada were down 33% at 580 mt. Exports to Peru were up 69% at 504 mt. In Central America, exports were higher than last year to all top 3 destinations: Guatemala (209 mt, up from 25 mt last Jan and the highest since 2012), Costa Rica (124 mt, up from 1 mt last Jan), and Honduras (100 mt, up from 28 mt last Jan).

In January, the beef/bvm export total was down 720 mt from last year, as higher exports to Japan (+1,960 mt), the ASEAN (+1,540 mt), Korea (+770 mt), Africa (+770 mt), Central America (+430 mt), the Caribbean + DR (+310 mt), and Mexico (+60 mt) and steady exports to Taiwan and the EU were offset by lower exports to China/HK (-3,900 mt), South America (-1,010 mt), Canada (-880 mt), and the Middle East (-730 mt).

January beef exports accounted for 9.7% of production and 12.2% when adding variety meats, down from 10.1% and 12.4% in January 2018.

January beef export value per head of fed slaughter averaged $284.86/head, down $8.20/head or -3% from $293.06/head for January 2018.

SOURCE: USMEF