American Beef Export Trade Stats: August 2019

Beef Highlights:

August 2019

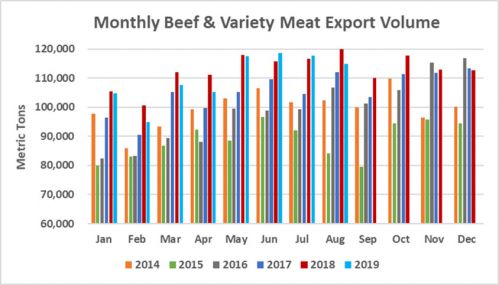

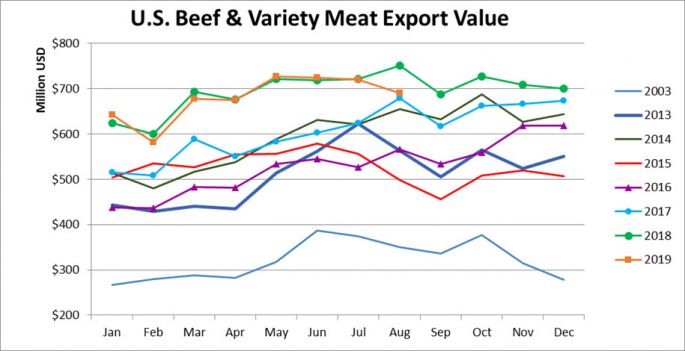

Beef: 86,153 mt, -9%, $608 million -11%

BVM: 28,776 mt, +17%, $83 million, +15%

Beef + BVM: 114,919 mt, -4%, $690 million, -8%

January – August 2019:

Beef: 666,163 mt, -4%, $4.802 billion, -3%

BVM: 215,363 mt, +4%, $637 million, +10%

Beef + BVM: 881,526 mt, -2%, $5.439 billion, -1%

The beef numbers look dismal on the surface, but this compares to essentially record exports in Aug 2018 and I think the slowdown is partly due to the plant fire and the following jump in U.S. prices (for products like chuck rolls as well as the short plate primal and middle meats) and juggling of product to service the export markets, etc.

The big drop to Japan and slowdown to Korea can thus probably be partly explained by Tyson’s temporary loss of the Holcomb plant. But Japan also has large beef inventories and likely held off further purchases until prices stabilized and given the continued duty disadvantage, until the “early harvest” agreement is implemented.

Korea showed solid quarantine cleared volumes from the U.S. in Sept and we generally expect continued strong demand.

It is also good to see the larger beef volumes for Indonesia and Vietnam and continued strength to the Philippines. C/S America and Carib/DR also held strong.

As a side note, prices for short ribs and chuck short ribs have been weak for much of this year (see charts at bottom). We had a “push” request today, for even more help marketing U.S. boneless short ribs and chuck short ribs in Japan, Taiwan, Indonesia and Vietnam!

August beef exports accounted for 11.3% of production and 14.0% when adding variety meats, as compared to 12.2% and 14.3% in August 2018.

For January – August, beef exports accounted for 11.6% of production and 14.2% when adding variety meats, down from 12.1% and 14.6% last year.

August beef export value per head of fed slaughter averaged $298.94/head, down $21.92/head or -7% from $320.86/head for August 2018. For January – August, beef export value per head averaged $309.85/head, down $9.36/head or -3% from $319.21/head last year.

SOURCE: USMEF