American Beef Export Trade Stats: April 2019

Beef Highlights:

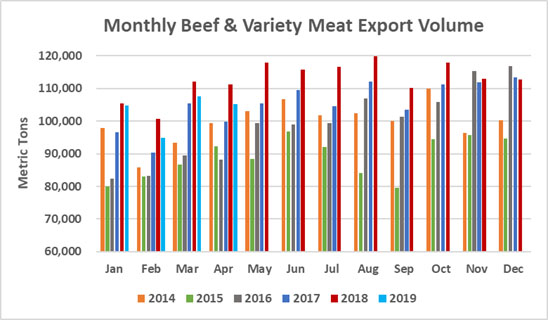

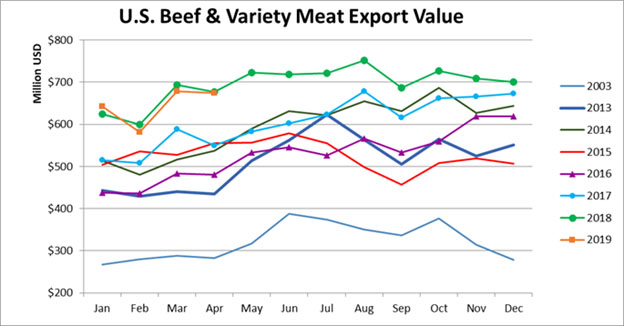

April 2019:

Beef: 80,859 mt, -3%, $597 million, -1%

BVM: 24,382 mt, -12%, $77 million, +5%

Beef + BVM: 105,241 mt, -5%, $674 million, -0.4%

January – April 2019:

Beef: 310,121 mt, -4%, $2.266 billion, -2%

BVM: 102,426 mt, -3%, $311 million, +7%

Beef + BVM: 412,547 mt, -4%, $2.576 billion, -0.7%

In April, higher U.S. beef muscle cut exports to Korea (+3,600 mt), the ASEAN (+930 mt), Taiwan (+690 mt), South America (+640 mt), the Middle East (+430 mt), and the Caribbean + DR (+100 mt) were outweighed by lower exports to China/HK (-3,400 mt), Japan (-2,300 mt), Canada (-1,500 mt), Mexico (-780 mt), the EU (-450 mt), Central America (-230 mt), and Africa (-200 mt). Korea was the top destination for U.S. beef muscle cut exports in April at 21,373 mt, up 20% from last year and the 7th highest monthly volume on record. Exports to Japan were below year-ago levels for the second consecutive month in April at 19,154 mt, down 11% from last year. Beef exports to Mexico had been above prior year levels for the past 12 months before dipping below last year’s large April volume this April at 11,898 mt, down 6%. Exports to Canada, on the other hand, have been below year-ago levels since last August and were down 17% in April at 7,103 mt. Exports to Taiwan continued to be above last year’s record pace with exports of 5,118 mt in April, up 15% from last year and the 7th largest month volume on record. Exports to China/HK were down 37% at 5,823 mt as the slowdown to HK continued to pull down exports. Exports to HK were 5,097 mt, down 41% from last year the lowest since 2015 apart from this February. Exports to China were 726 mt, up 12% from last year and the highest since 800 mt in January. Exports to the ASEAN were up 37% from last year on record high monthly exports to the Philippines (1,516 mt, +105%). Exports were also higher to Vietnam (887 mt, +39%), but exports were lower to Indonesia (556 mt, -29%). Exports to South America were the highest since last August as exports to Chile (968 mt, +178%) were the highest since last February, and exports to Colombia (388 mt, +34%) remained above last year’s record pace. Exports to the DR (598 mt, +6%) were higher than last year, and for the Caribbean, exports were steady to the Bahamas (311 mt) and the Netherlands Antilles (234 mt), and exports were higher for Jamaica (184 mt, +61%). Exports to the Middle East were the highest since last February with higher exports to the UAE (557 mt, +18%), Kuwait (319 mt, +36%), Israel (200 mt, +136%), and Saudi Arabia (196 mt, +136%). In Central America, exports continued to slow to top market Guatemala (282 mt, -23%).

Japan (+760 mt) was one of the few growth markets for U.S. bvm exports in April, and exports were also higher to the Caribbean + DR (+180 mt) and the ASEAN (+40 mt). BVM exports were lower to other markets including Mexico (-1,300 mt), the Middle East (-1,200 mt), Africa (-1,000 mt), China/HK (-310 mt), Canada (-230 mt), South Korea (-190 mt), South America (-160 mt), the EU (-90 mt), and Central America (-50 mt). Mexico is the top market for bvm exports, but exports have been below year-ago levels since last April. This April, exports to Mexico were 7,381 mt, down 15% (but value was up 4%). Japan surpassed the Middle East as the second largest bvm export market in April. Exports to Japan were 4,995 mt, up 18% and the highest since last June. After rebounding somewhat in February and March, April bvm exports to Egypt fell to 4,732 mt, down 20% (but above the very low levels from last Nov – this Jan). BVM exports to HK were a record in 2018, and exports had maintained that strong pace early in 2019, but exports slowed in April to 1,424 mt, down 17% from last year. Exports to other top markets Korea (1,211 mt, -13%) and Canada (770 mt, -23%) were lower than last year. IN the ASEAN, exports were steady to Indonesia (596 mt), were lower to the Philippines (490 mt, -20%), and were higher to Vietnam (149 mt, up from 13 mt last year). Exports were higher to Peru (587 mt, +6%) and Jamaica (580 mt, +14% and the highest since 2011). Exports to Africa slowed significantly in April (down 60% year-over-year). Exports to South Africa slowed in March and further decreased in April to 184 mt, down 81% from last year and the lowest since November 2017. Exports were also lower to Angola (210 mt, -56%), but exports increased to Gabon (155 mt, +46%).

For January – April, total beef and bvm exports were down 16,700 mt from last year. Exports were higher to Korea (+7,700 mt), the ASEAN (+2,900 mt), the Caribbean + DR (+1,300 mt), Taiwan (+1,100 mt), Central America (+210 mt), Japan (+210 mt), and the Russia region (+50 mt). Exports were lower to China/HK (-15,800 mt), Canada (+5,650 mt), the Middle East (-3,300 mt), Africa (-1,600 mt), Mexico (-1,600 mt), the EU (-1,350 mt), and South America (-740 mt).

April beef exports accounted for 10.2% of production and 12.5% when adding variety meats, as compared to 11.3% and 14.1% in April 2018. For January – April, beef exports accounted for 10.2% of production and 12.7% when adding variety meats, down from 10.8% and 13.4% last year.

April beef export value per head of fed slaughter averaged $305.61/head, down $22.84/head or -7% from $328.45/head for April 2018. For January – April, beef export value per head averaged $308.34/head, down $10.57/head or -3% from $318.91/head last year.

SOURCE: USMEF